The cryptocurrency landscape is rapidly evolving, and as we approach 2025, the demands on mining operations are set to become more intricate. The future of mining machines and hosting services hinges on multiple factors, including technological advancements, regulatory changes, and the fluctuating tides of market demand. A comprehensive buyer’s guide is essential to navigate this dynamic ecosystem, ensuring that your mining operation remains competitive and efficient.

First, understanding the capabilities of different mining machines is crucial. Bitcoin, Ethereum, and emerging cryptocurrencies such as Dogecoin each have distinct mining requirements. Bitcoin (BTC), the pioneer of digital currencies, requires specialized hardware known as ASICs (Application-Specific Integrated Circuits) to compete in its proof-of-work protocol. Meanwhile, Ethereum (ETH) remains vital as it transitions towards proof-of-stake; however, miners can still find reward potential through GPU mining, leveraging powerful graphics hardware. As you assess your options, ensure you consider the longevity and efficiency of the mining machines you intend to acquire.

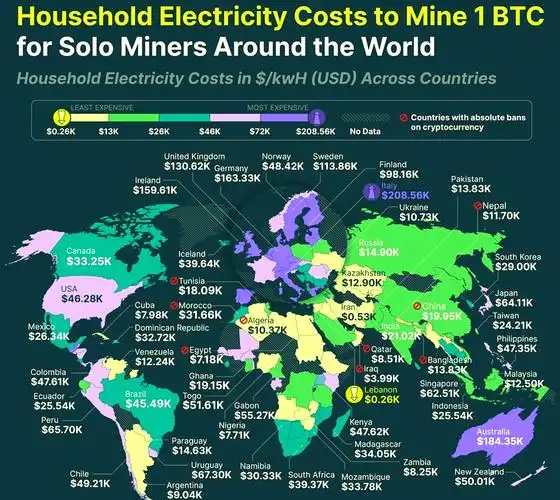

As you strategize your investments, evaluating hosting solutions becomes essential. Hosting services can optimize your mining operations, allowing you to operate in locations with favorable energy costs and regulatory environments. By leveraging a dedicated mining farm, you can reduce overhead while maintaining a focus on efficient mining practices. Look for hosting services that offer scalable solutions, robust security, and transparent pricing structures, ensuring that your operation has room to grow.

With diverse cryptocurrencies filling the blockchain eco-space, awareness of altcoin mining opportunities like Dogecoin (DOGE) can diversify your portfolio and enrich your revenue streams. As meme coins attract attention and undergo cycles of popularity, having the flexibility to pivot your mining strategy can provide a competitive edge. Diversifying your mining portfolio not only protects against the volatility of a single cryptocurrency but also opens doors to new markets and potential profits.

When choosing a mining rig, pay attention to energy efficiency and hash rate performance. The power consumption determines the profitability of mining operations, especially as energy costs continue to fluctuate. Focus on models that strike a balance between hash power (the power behind processing transactions) and operational costs. Investing in advanced cooling solutions can also enhance performance while prolonging the lifespan of your mining equipment, making it an essential consideration.

In 2025, regulatory implications might shape mining operations significantly. As governments around the world grapple with the rise of cryptocurrencies, compliance with local laws will be imperative. Regulatory frameworks can influence aspects like taxation, energy consumption, and even restrictions on certain cryptocurrencies. Staying ahead of potential changes requires vigilance; aligning your operations with legal expectations will not only safeguard your investments but also enhance your standing in the community.

Moreover, the development of mining pools has made it easier for individual miners to collaborate and increase their chances of success. By joining forces, miners can combine their processing power, leading to faster rewards and a more stable income stream. This pooling strategy is particularly effective for less established cryptocurrencies, where solo mining may not yield sufficient returns. The 2025 landscape will likely see heightened collaboration within mining communities, further promoting innovation and shared success.

Lastly, monitoring exchange trends and their relationship with mining operations is paramount. The exchange prices of cryptocurrencies directly impact mining profitability. Keeping tabs on market movements can influence your mining decisions, allowing for timely adjustments to your strategy. Utilizing trading alerts and analytics can help you stay informed, and ultimately, make strategic bandwidth allocations based on the highest profitability currencies.

In conclusion, securing the right mining machines and fostering a resilient mining operation by 2025 requires a multifaceted approach. Embrace technological advancements, leverage efficient hosting solutions, diversify with emerging coins, align with regulatory shifts, and ensure robust collaboration in mining pools. The rapidly changing world of cryptocurrencies demands adaptability, but with thorough research and proactive strategies, your mining operations can thrive in the years to come.

Leave a Reply